- Global Markets

- Interest Rates

- Cross-Currency-Swap

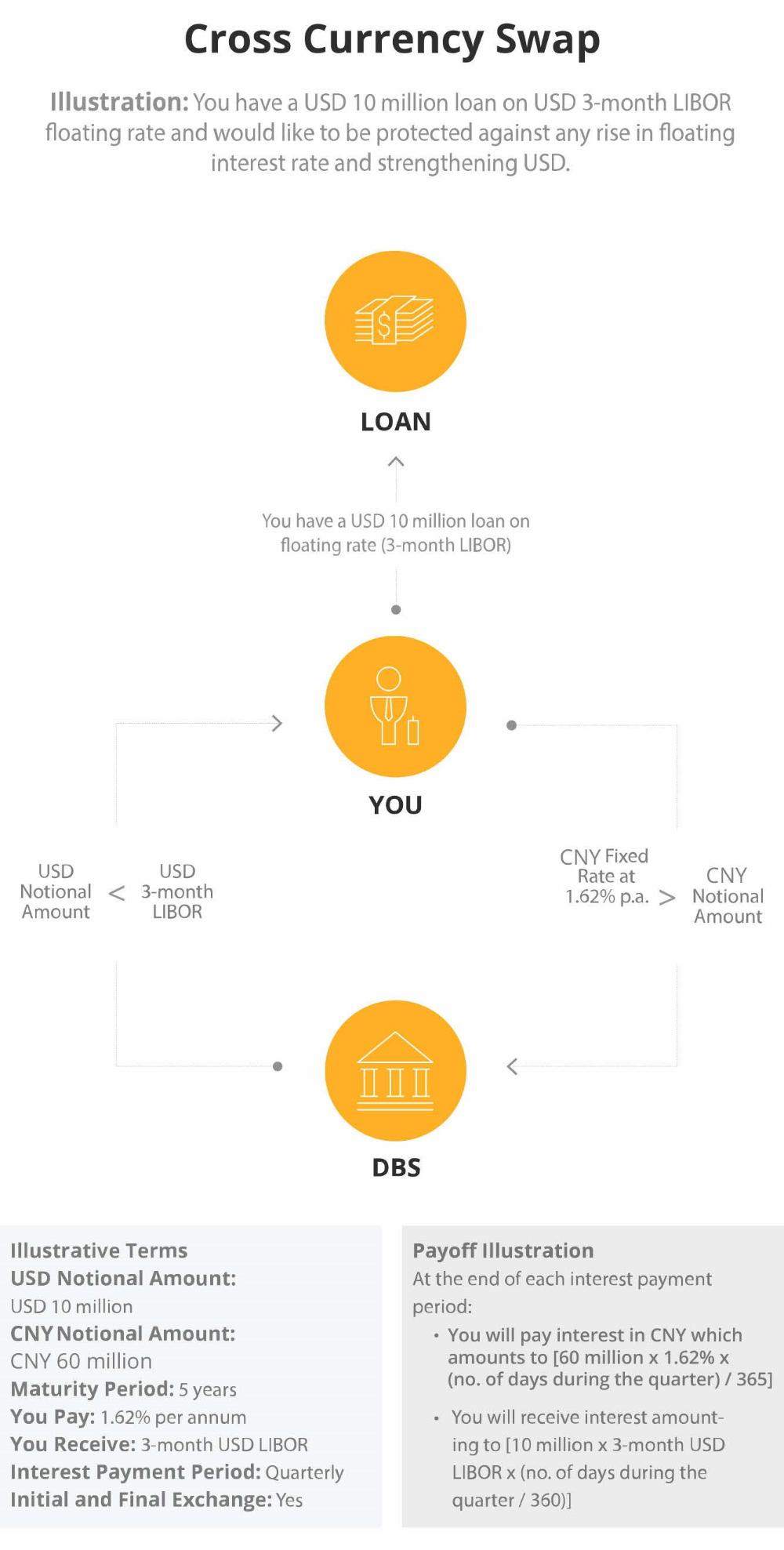

Cross-Currency Swap

Hedge against currency and interest rate exposure

- Global Markets

- Interest Rates

- Cross-Currency-Swap

Cross-Currency Swap

Hedge against currency and interest rate exposure

Interest rate certainty

This is an agreement between two parties to swap future interest payments, based on a principal amount in one currency for an equivalent amount in another currency.

Enjoy competitive pricing due to our market leader position and extensive network

Stay informed of the latest market developments with insights from more than 100 DBS research analysts in Asia

Leverage the knowledge of our dedicated SME advisory sales team to identify and hedge against interest rate volatility

Conduct sophisticated cross-border transactions smoothly and efficiently with strategic advice from our regional advisory sales network

You can choose to pay in a different currency on either a fixed or floating rate.

Call us on 400 821 8881 or visit any of our Branches for more details. You may also email us and arrange our Relationship Manager to call you.

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?