DBS digibank CN Frequently Asked Questions and Guideline

Get Started with DBS digibank

All you need is any Apple iPhone with iOS 15.0 or higher, or an Android device running Android 10.0 or higher.

Due to compatibility issues that Huawei HarmonyOS NEXT does not support any Android app, including our DBS digibank CN app. If you are using Huawei device with HarmonyOS NEXT version or above, DBS digibank CN service will no longer be supported. If there is any inquiry, please contact your relationship manager or call DBS Customer Service Hotline 4008208988 for help.

We offer 2 convenient download methods:

- Download from Official App Stores

Search for “DBS digibank CN” from Apple App Store/Huawei App Gallery/vivo App store/OPPO App store/Tencent MyApp(YingYongBao)/Xiaomi GetApps/Honor App Market/Google Play/Baidu App Gallery(百度手机助手) to download the App.

- Scan the QR Code to Download

Scan the QR code below to download the application.

All DBS China individual customers who are at least 18 years old can register DBS digibank CN as following:

- Use a valid mobile phone number registered in the Bank, and

- Pass one of the following identity verifications:

- Facial Recognition (only applicable to customers who opened DBS account with PRC ID)

- DBS China Debit Card and PIN

- Email OTP received in the email address registered in the Bank

For existing iBanking Transaction Mode Customers

Simply use your existing DBS iBanking username and password to log in to DBS digibank CN.

For existing iBanking Inquiry Mode Customers

You shall register for DBS digibank CN first to use the service.

You can retrieve your username via DBS digibank CN. Please click “Forgot Username" on the login page to retrieve username.

You can reset your password via DBS digibank CN. Please click “Forgot Login Password" on the login page to reset it.

Please check wireless data of DBS digibank in your device “Settings”, to make sure WLAN and/or Mobile Data enabled.

Please check if your mobile banking app is upgraded to the latest version. If you are unsure of the installed version, it is recommended that you re-download and install the app before attempting to log in.

Please refer to Question 2 for mobile banking app download instructions.

It is suggested to follow tips as below:

- Check whether you are using a mobile phone number which is registered in the Bank to receive SMS OTP for DBS digibank CN

- Check if your mobile phone is out of network coverage. Please ensure international roaming service is activated when you are overseas.

- There may be some service delays or interruptions by your mobile service providers. Please try again later.

- Check whether any software installed in your phone may block your SMS

- SMS inbox of your phone may be full. You may need to delete some SMS from your phone inbox before new incoming SMS can be received.

- Check whether your SMS OTP is in junk SMS inbox. If so, please add DBS number into your phone whitelist to avoid SMS OTP being junk again.

- You can setup Transaction PIN thus SMS OTP verification will be replaced by Transaction PIN authentication

If you still cannot receive SMS OTP, please call DBS hotline at 400 820 8988 for help.

Service may not be available if DBS digibank migrated from your previous device. Please uninstall the application and redownload the latest version.

Please refer to Question 2 for mobile banking app download instructions.

Please ensure that you have updated your DBS digibank CN to the latest version on official App Store/App Gallery.

You may refer to below troubleshooting tips:

- Uninstall DBS digibank CN app

- Restart phone and ensure Android or iOS is running on latest version

- Re-install DBS digibank CN app

If you are still experiencing issues, please contact your relationship manager or call DBS hotline at 400 820 8988.

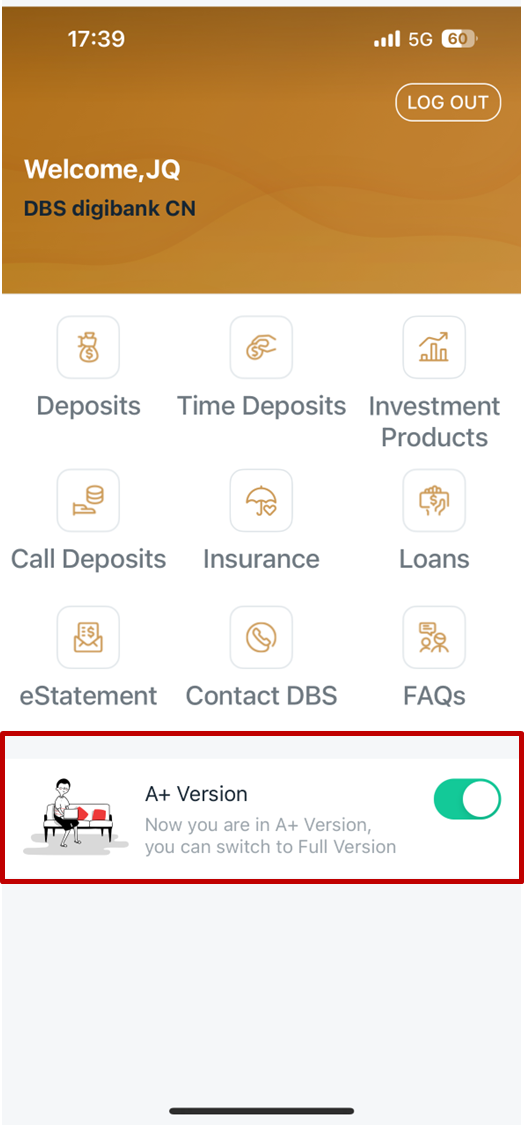

Please toggle off as shown in the screen. If no toggle off function on homepage, please reach out your relationship manager for help.

Peek Balance

Once Peek Balance is enabled, you are able to take a quick view on available balance and latest transaction of the saving account you selected without logging in.

Yes, you have a choice to toggle off “Peek Balance” anytime. Please click “More”-“Peek Balance” after you login digibank, and set up by following the page prompts.

Without performing this setup, Peek Balance will be default as “Toggle Off” status.

Face ID or Touch ID Login

Yes. You can enable Face ID on iPhone X or later by following approaches:

- Enable Face ID after you log in to DBS digibank CN, under “Face ID” in “More” tab

- Also, you need to allow using Face ID for DBS digibank CN in your iOS Settings

For other mobile phones which support Touch ID, you can enable Touch ID to login DBS digibank CN with similar settings.

No, it is required to reset in your new device to enable Face or Touch ID login.

If you have not performed the one-time setup on your mobile phone to enable Face or Touch ID login, you can continue using your username and password to log in to DBS digibank CN.

If you have enabled Face or Touch ID, please click “More”- “Face ID” or “ Touch ID” after you log in to digibank, and disable it by following page prompts.

Local Fund Transfer

With IBPS(Internet Banking Payment System), 24/7 CNY Local Transfer from/to DBS is supported.

Customer can select Normal or Instant during CNY Local Transfer out from DBS Bank.

If Beneficiary Bank support IBPS and Transfer Amount per deal within 1 million CNY, transfer will be default as Instant Transfer, normally funds will be arrived in 20 seconds, while the actual arrival time depends on the process of recipient’s bank.

If Beneficiary Bank does not support IBPS or Transfer Amount per deal excess 1 million CNY, only Normal transfer could be supported:

- Transfer submitted during working hours, which is Monday to Friday (Holiday excluded) from 8:00 to 16:00, will be processed in real time, and the actual arrival time depends on the process of Beneficiary Bank.

- Transfer submitted during non-working hours, will be processed in next period of working hours

IBPS, the online inter-bank payment liquidation system of People’s Bank of China, is to support 24/7 real time CNY domestic transfer.

You can login DBS digibank CN view and change your transfer limits . If you need to increase your CAP allowed by the Bank, please visit any DBS China branch or contact your relationship manager for details.

Transaction PIN & Digital Cert

The digital certificate uses a secure encryption algorithm to protect your transaction. You can download digital certificate and setup 6 digits Transaction PIN in your phone for DBS digibank CN transaction authentication.

View More Transaction Risk Level and When Transaction PIN shall be used.

No. Transaction PIN as well as it’s digital certificate will take the role to facilitate transactions which require a higher level of authentication.

A digital certificate is for one person in one mobile only. Therefore, you can download the digital certificate in the new mobile phone and then original Transaction PIN can be used in new device. The digital certification in old mobile phone will be automatically become invalid once you complete redownloading.

Please call DBS Hotline 4008208988 immediately to apply for digital certificate revocation, or you can download the digital certificate in the new mobile phone thus your previous digital certification in lost mobile phone will automatically become invalid.

You can authenticate via SMS One-Time-Password for transactions which do not require a higher level of authentications.

It’s recommended that you use digital certificate and transaction PIN. Once you have completed digital certificate download and transaction PIN setup, all medium risk rated transactions shall by default be authenticated by Transaction PIN as well.

If you delete DBS digibank CN app, revoke the digital certificate or change a mobile phone, please redownload the digital certificate. The original Transaction PIN can be continually used.

The digital certificate can be only downloaded and installed in one mobile phone. The original digital certificate will become invalid in old mobile phone once you complete redownloading in new mobile phone.

Only one digital certificate can be installed in one mobile phone. If there is valid digital certificate in the mobile phone, others cannot download another digital certificate in the same mobile phone.

Third-party Payment

Before you pay through payment apps (like WeChat Pay, Alipay, UnionPay and JD Pay and others), please visit any DBS branch to enable third-party payments. Once enabled, simply bind your debit card in payment app.

Suspend or Cancel DBS digibank

If you want to suspend DBS digibank CN, please visit our branch or call DBS hotline at 400 820 8988. Service can be resumed later as per your application.

If you want to cancel DBS digibank CN, please visit our branch or call DBS hotline at 400 820 8988. If you‘d like to re-open DBS digibank CN service, you need to complete online registration in the app.

Useful Links

Need Help?

Customer Service & Complaint

Hotline: 400 820 8988

Customer Service & Complaint

Email: [email protected]

Or have someone contact you

- IPv6 Supported |

- 沪ICP备15020237号-2