Treasures Card

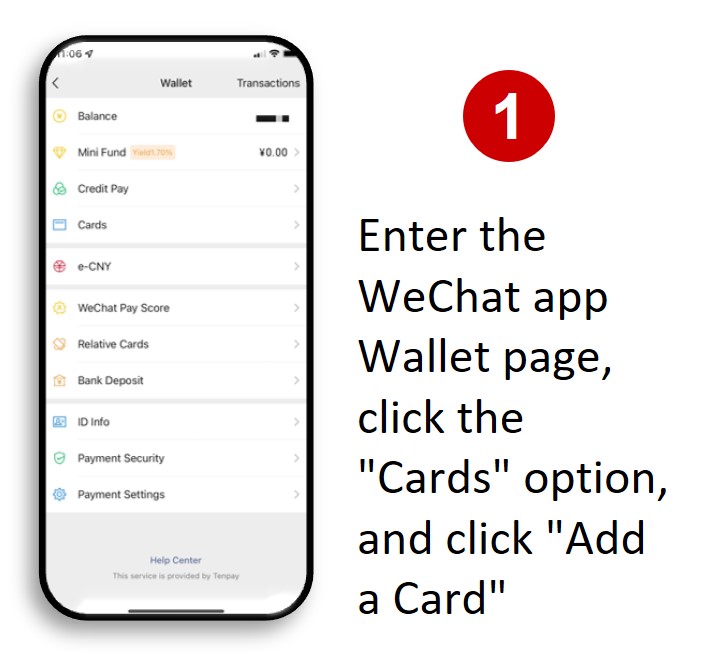

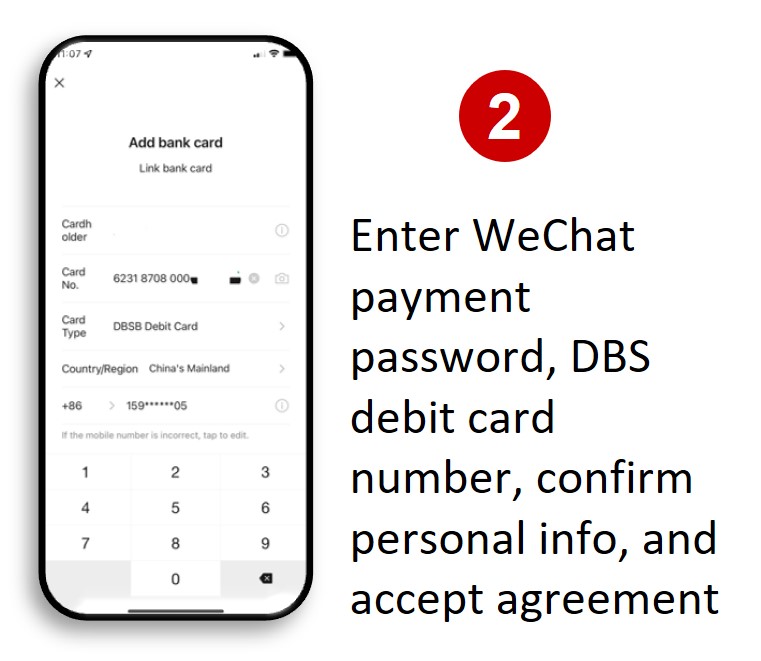

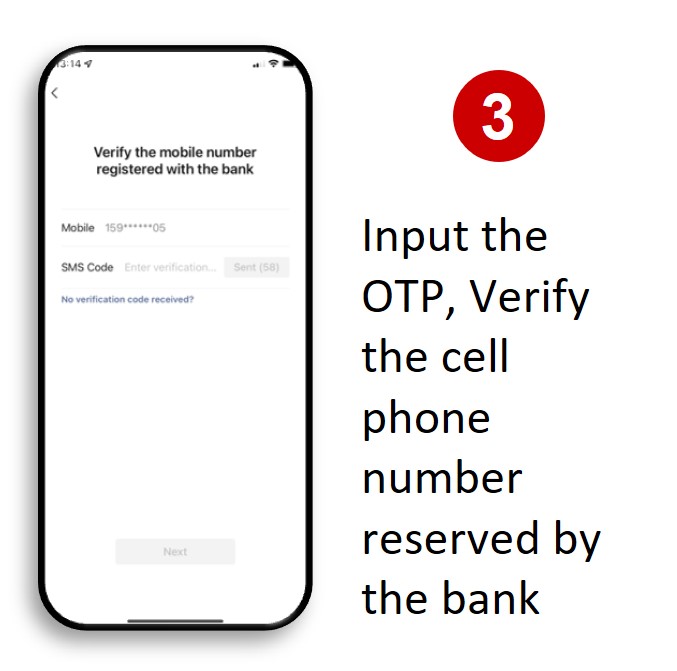

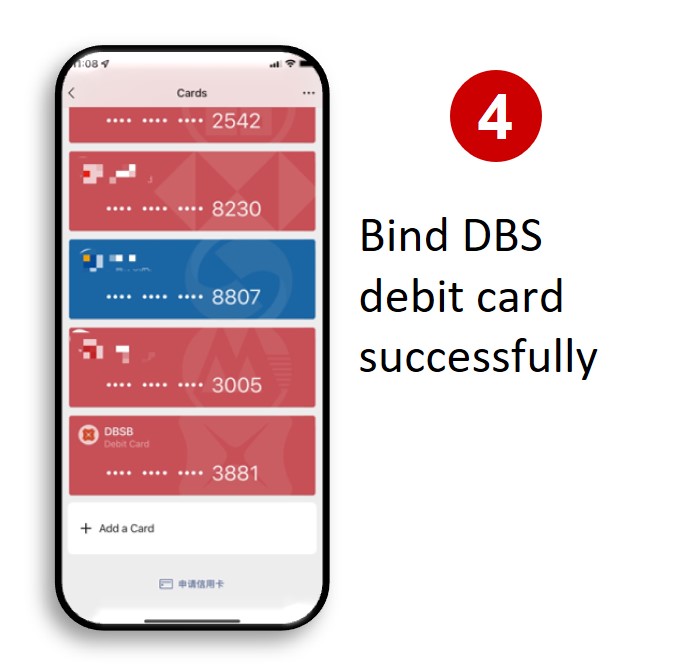

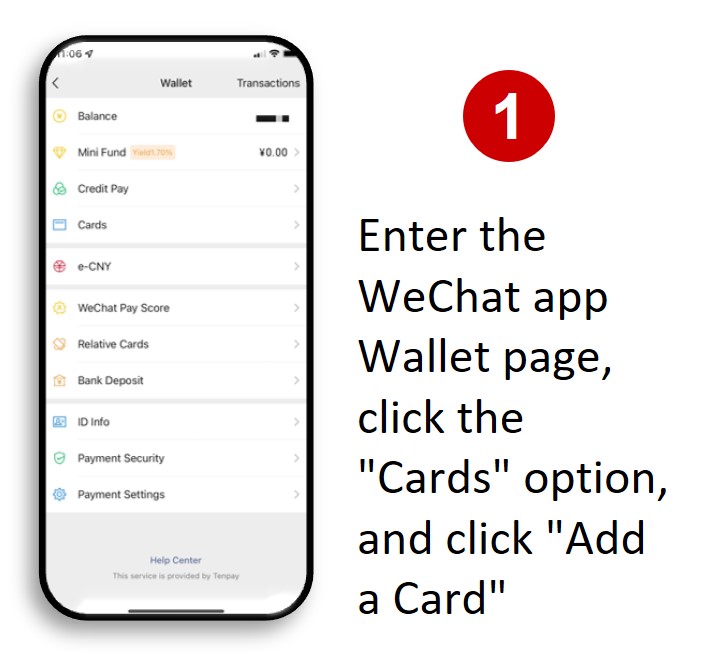

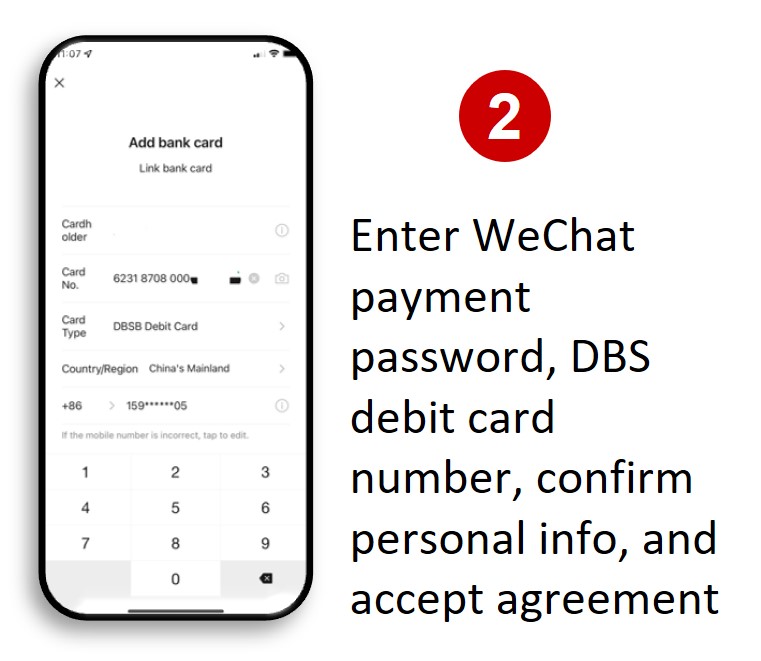

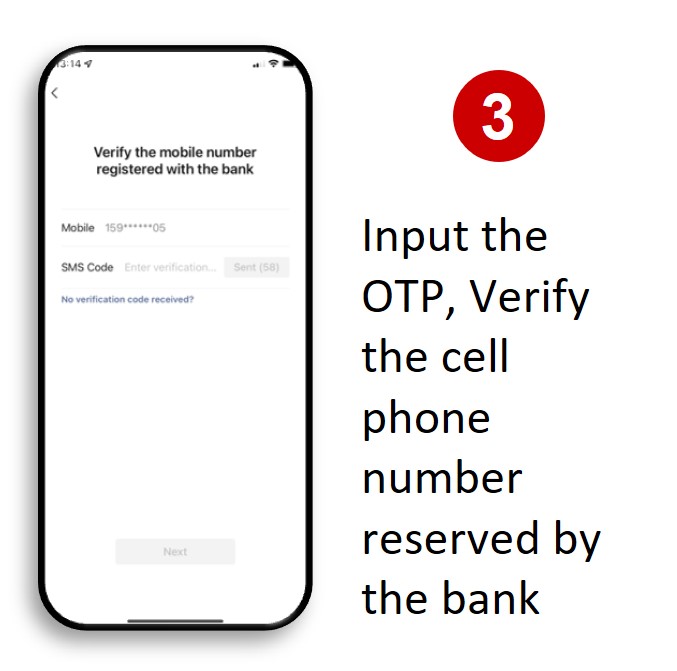

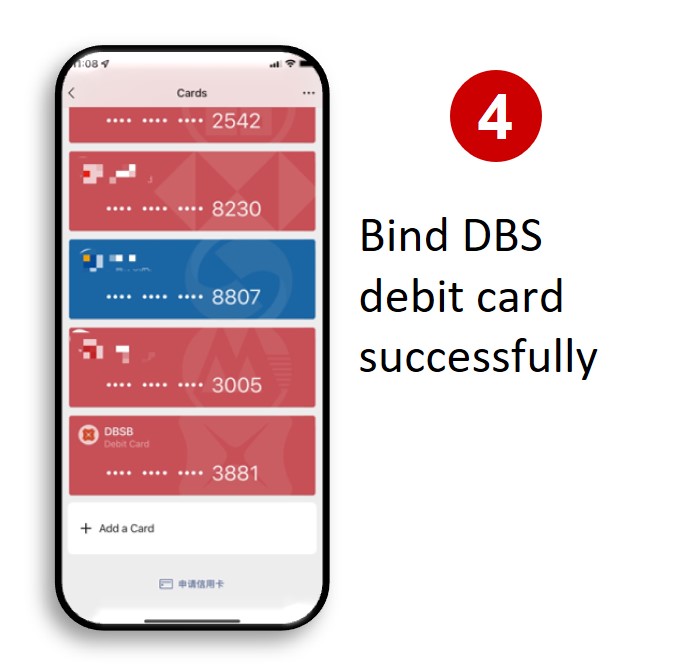

Customers bind DBS debit card through the WeChat payment module in the "WeChat" App and can use a variety of mobile payment services provided by WeChat Pay, including QR code payment, transfer, shopping, travel, and living expenses.

Guidance to bind DBS debit card in “WeChat” App:

|  |

|  |

|

|

|

|

Reminder: WeChat Pay is supported and operated by Tenpay. For more details, please visit the Tenpay website. As the WeChat App may be updated from time to time, the above-mentioned guidance is for reference only, and the actual operation shall prevail.

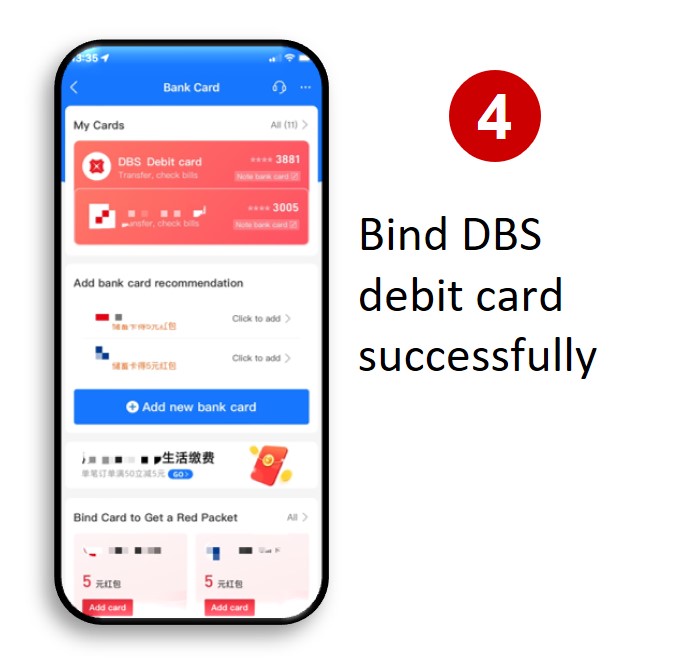

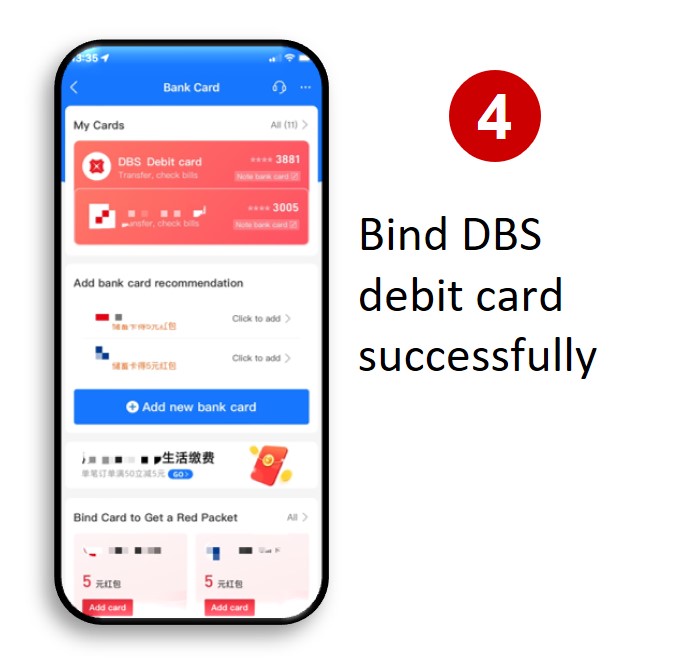

Customers bind DBS debit card through the "Alipay" App, and can use a variety of mobile payment services provided by the "Alipay" App, including payment, transfer, collection, credit card repayment and phone bills etc.

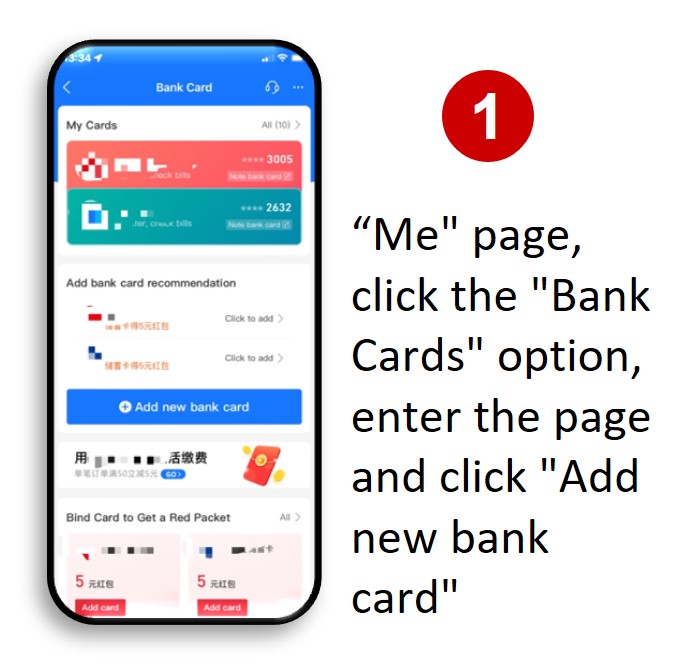

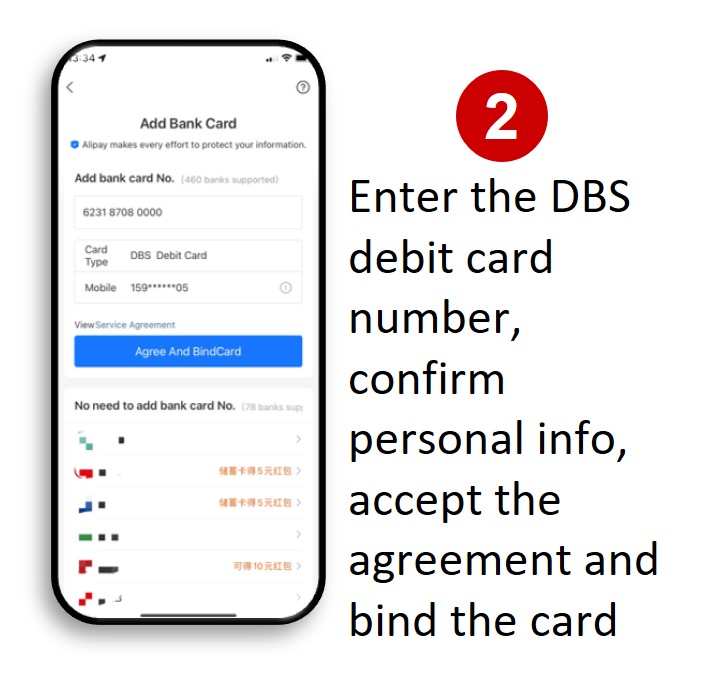

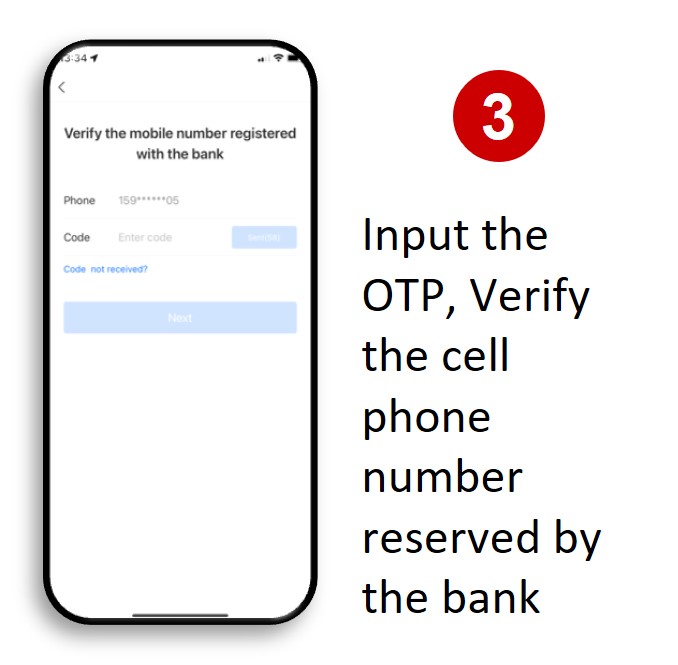

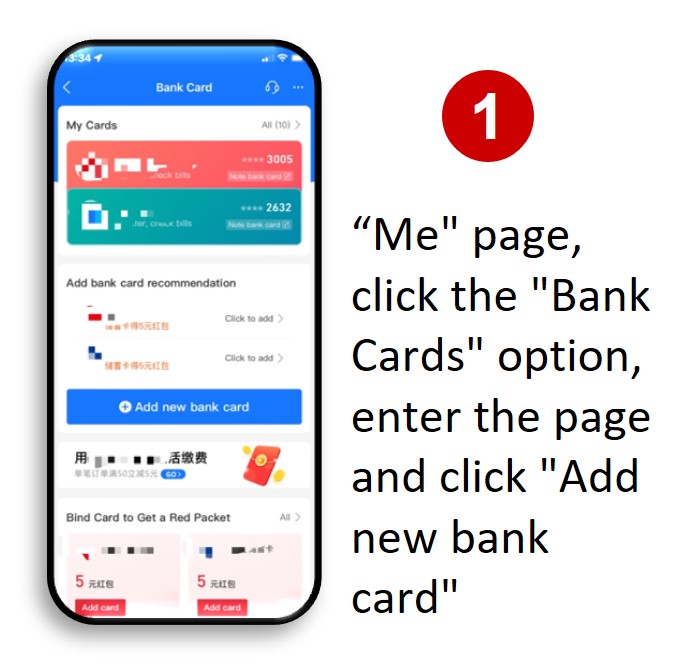

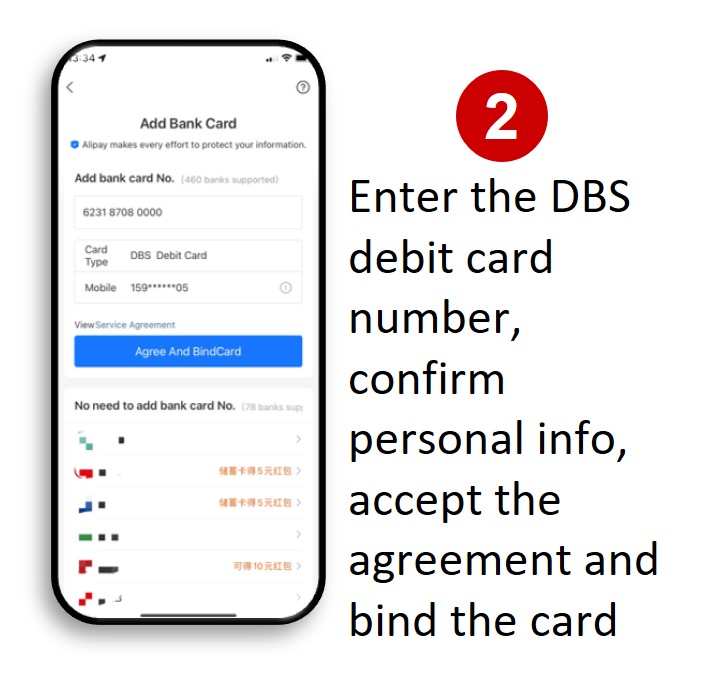

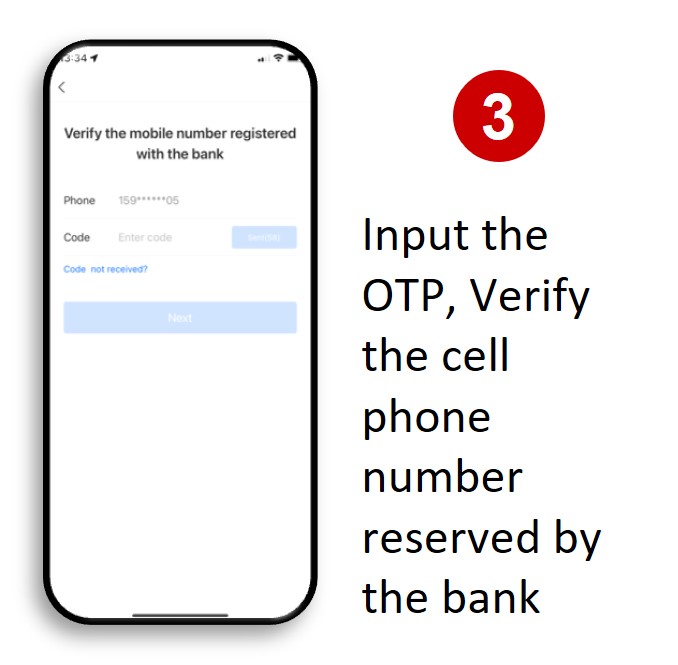

Guidance to bind DBS debit card in “Alipay” App:

|  |

|  |

|

|

|

|

Reminder: Alipay is a product of Ant Group. For more details, please visit the Alipay website. As the Alipay App may be updated from time to time, the above guidance is for reference only, and the actual operation shall prevail.

By binding the DBS debit card through the “UnionPay” App, customers can use a variety of mobile payment services provided by “UnionPay“ App, including QR code payment, Non-card payment, transfer, mobile QuickPass, and credit card repayments, etc.

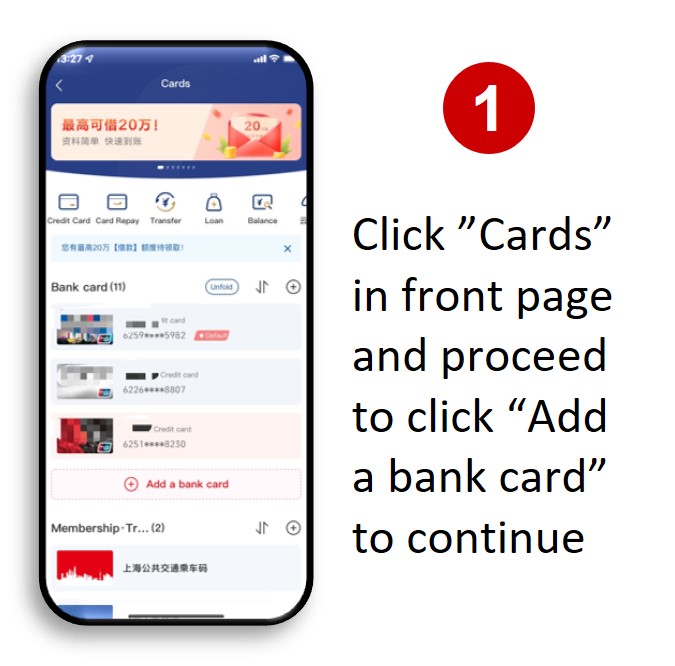

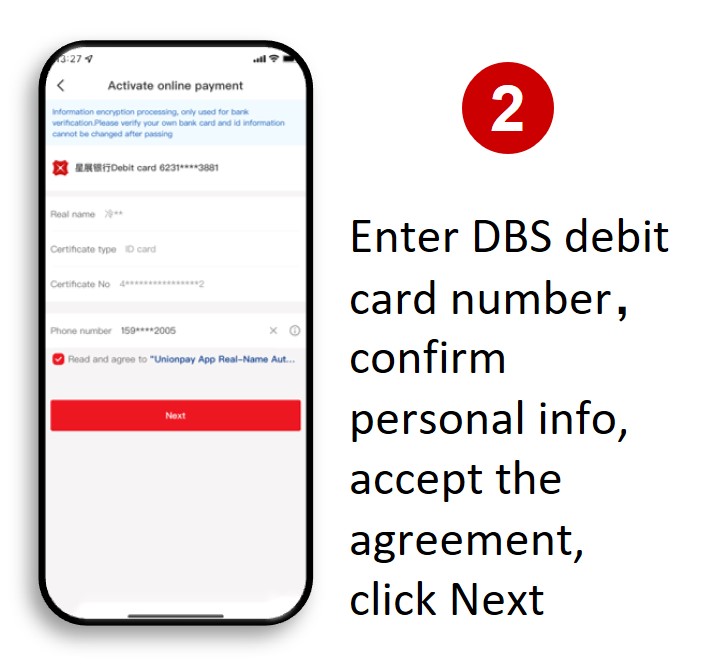

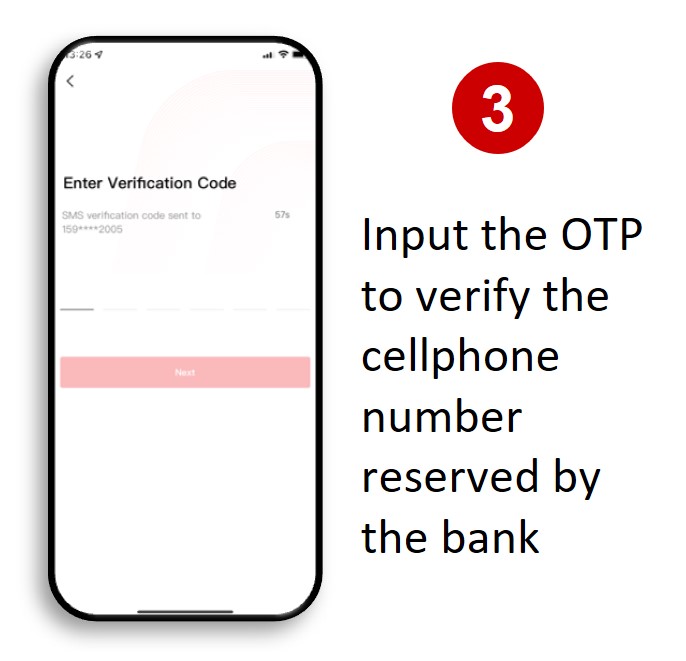

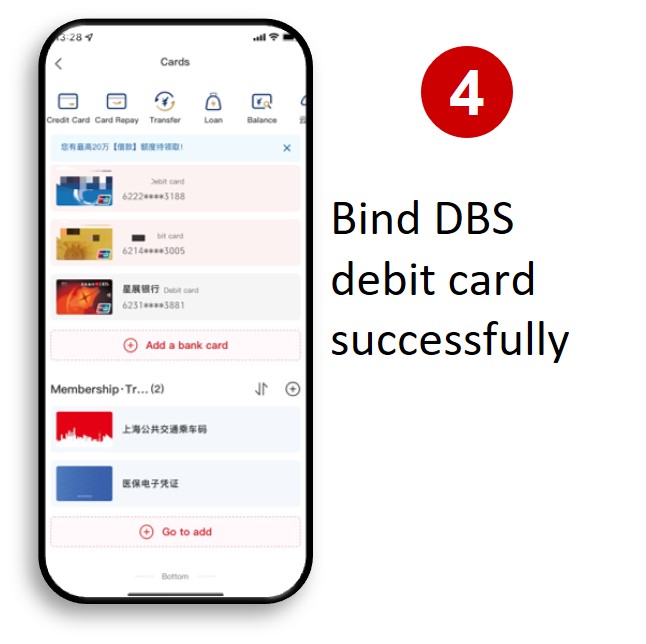

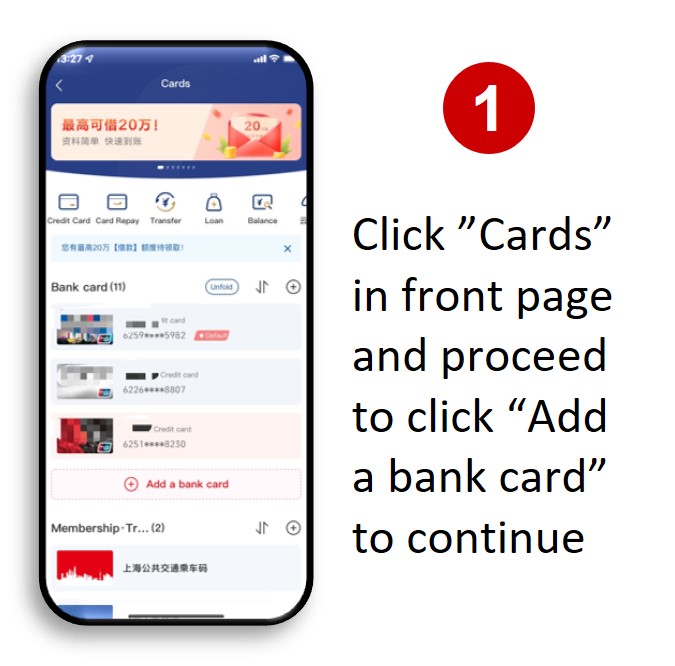

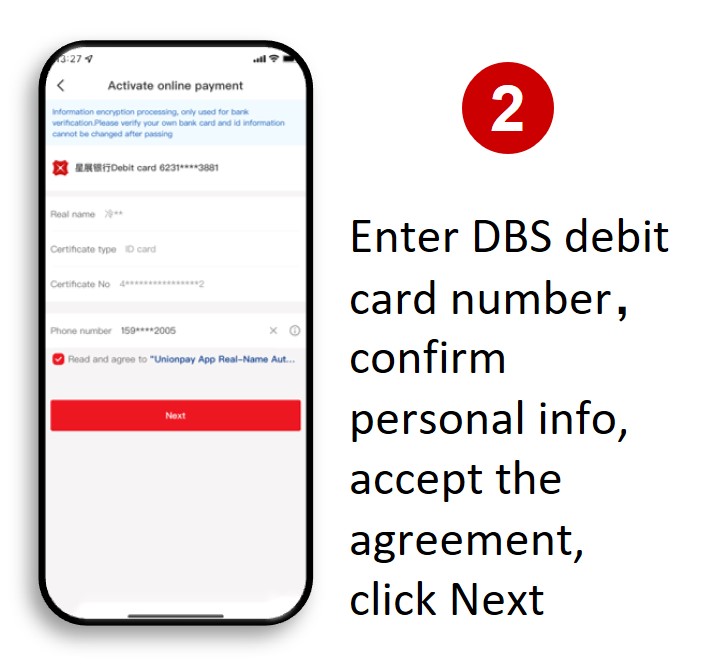

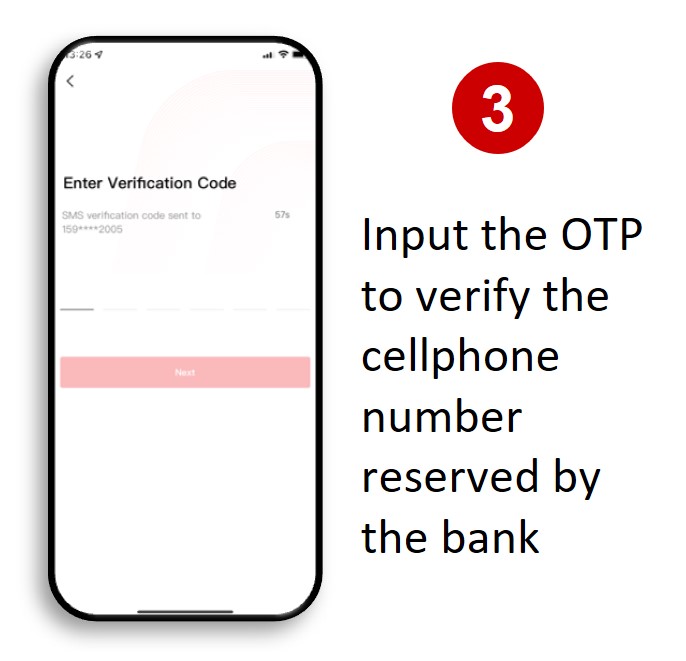

Guidance to bind DBS debit card in “UnionPay” App:

|  |

|  |

|

|

|

|

Reminder: “UnionPay” App is a mobile payment App provided by China UnionPay. For more details, please visit the China UnionPay website. As the “UnionPay” App may be updated from time to time, the above guidance is for reference only, and the actual operation shall prevail.

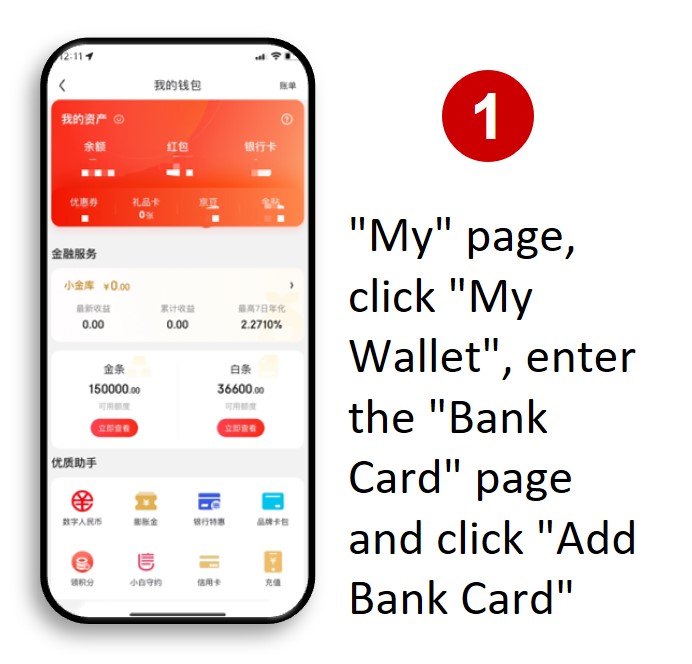

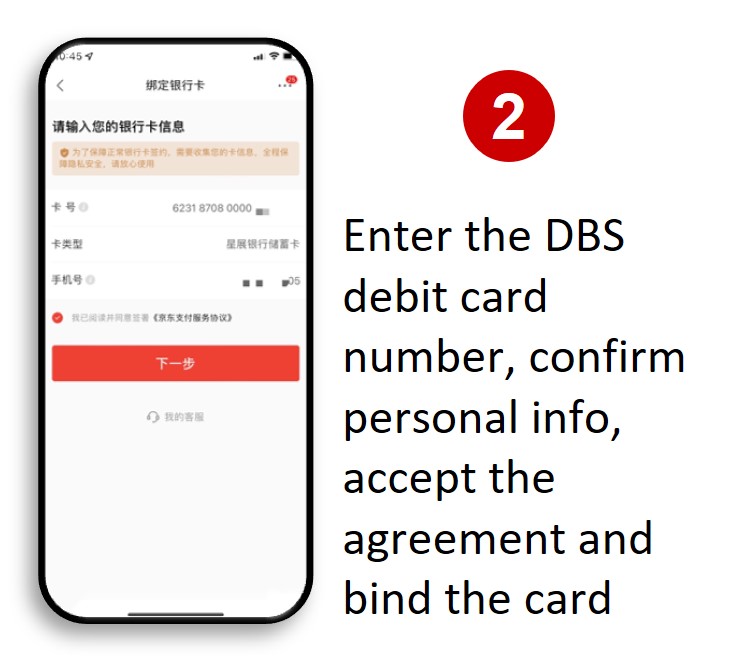

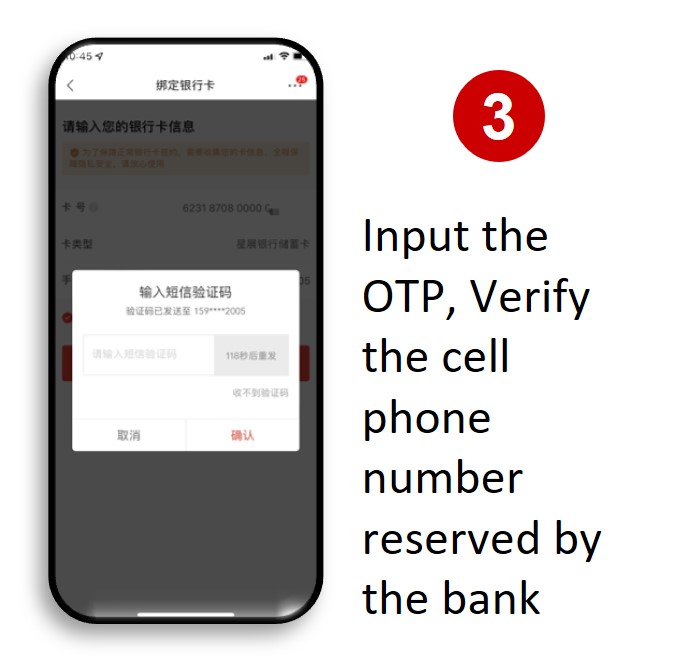

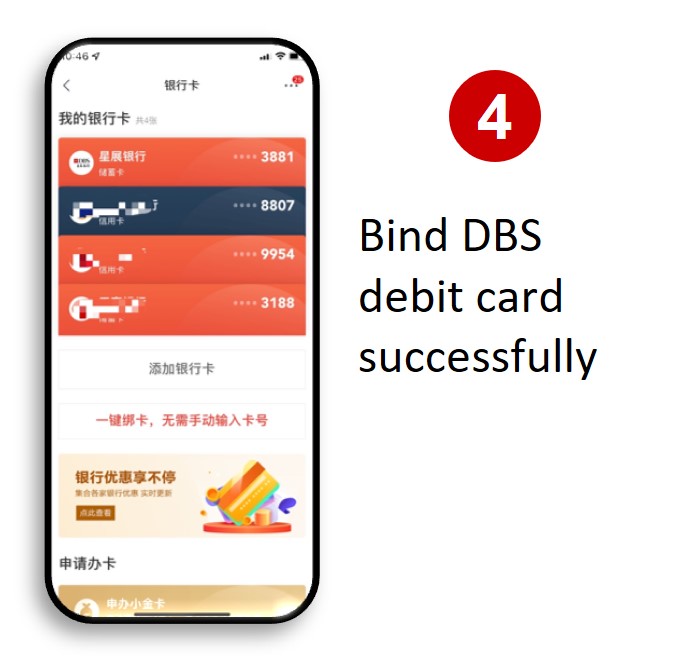

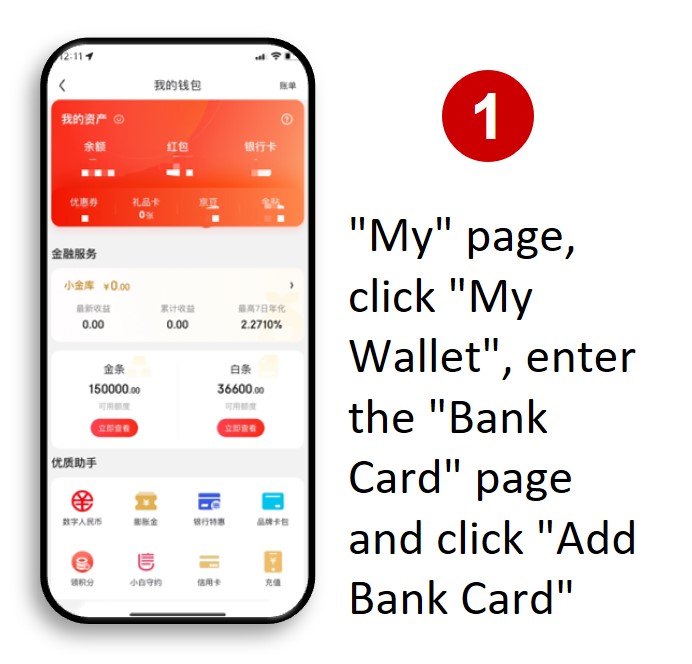

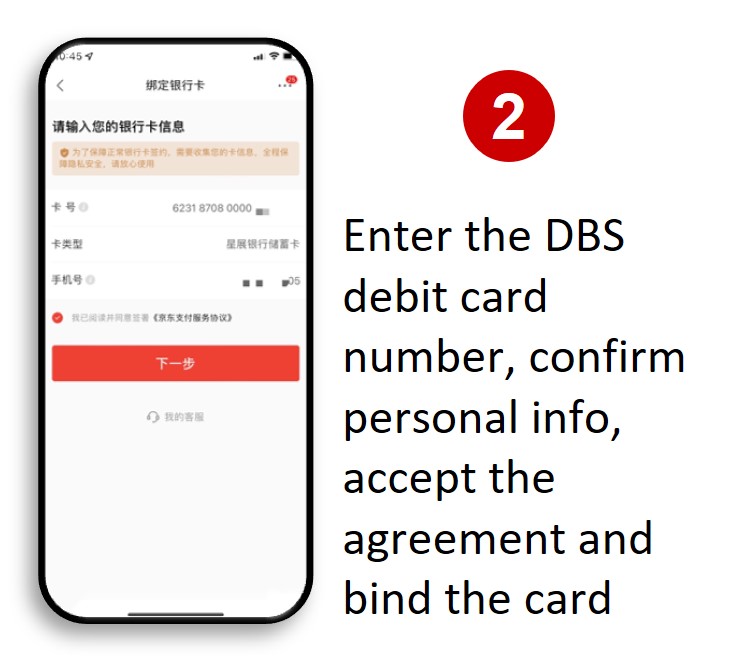

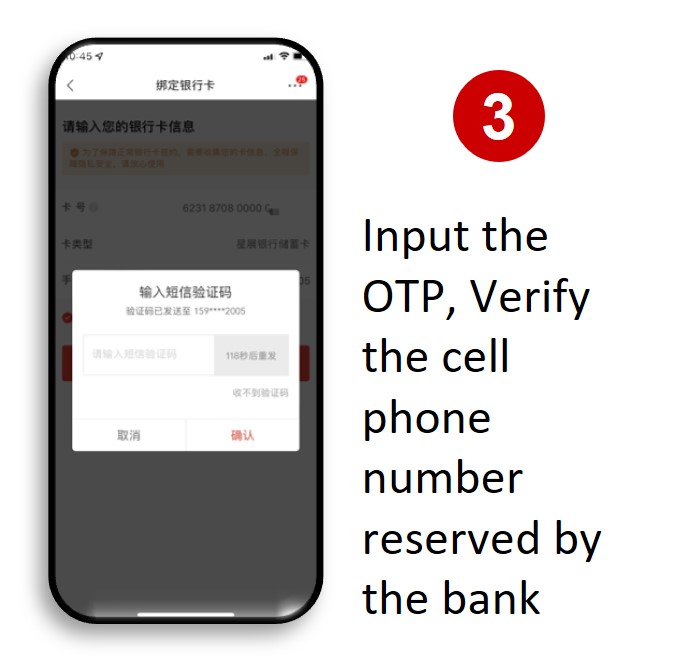

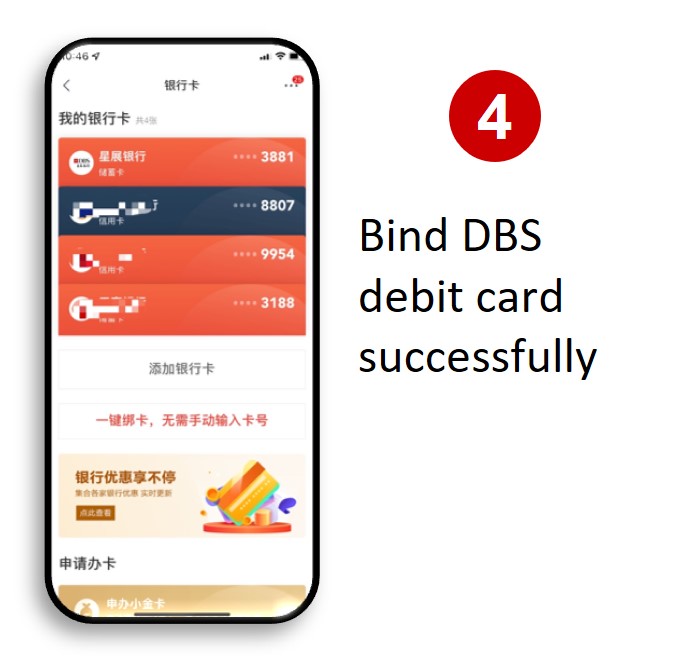

Customers bind the DBS debit card through the JD App and can use JD Pay to complete online payment on the JD App or JD Mall for shopping.

Guidance to bind DBS debit card in JD App:

|  |

|  |

|

|

|

|

Reminder: JD Pay is a product of JD Finance. For more details, please visit JD website. Since JD App may be updated from time to time, the above-mentioned guidance is for reference only, and the actual operation shall prevail.

- To activate Third-party Payment, please visit the counter at our sub-branches with your valid ID, DBS debit card, and other relevant materials.

- The daily limit of DBS debit card Third-party Payment is set at RMB 50,000 and is subject to other limit(s) imposed by third-party payment service providers.

- DBS does not charge any fees for Third-party Payment transactions. Please contact third-party payment service providers for more information regarding any fees or charge they may impose.

- Please keep your personal information secure. Do NOT provide others with sensitive information such as ID, passwords, bank card numbers, or dynamic verification codes. Please stay vigilant about cyber-telecom fraud and report any suspicious cases to the police immediately.

- For inquiries or assistance, please call our customer service hotline 400 820 8988 or contact our staff.

Useful Links

Need Help?

Customer Service & Complaint

Hotline: 400 820 8988

Customer Service & Complaint

Email: [email protected]

Or have someone contact you

- IPv6 Supported |

- 沪ICP备15020237号-2