Interest Rates - Bank Rates | DBS CN Corporate Banking

- Solutions

- Global Financial Markets

- Interest Rates

Interest Rates

Protect your business against interest rate volatility

- Solutions

- Global Financial Markets

- Interest Rates

Interest Rates

Protect your business against interest rate volatility

Please use valid input

Please provide your details to continue reading. Interest Rate Swap

With Interest Rate Swaps / Caps / Floors/ Swaptions, we can help you manage the interest expense you pay on your loans. We can offer the relevant instrument to enable you to better hedge interest exposures across a range of scenarios.

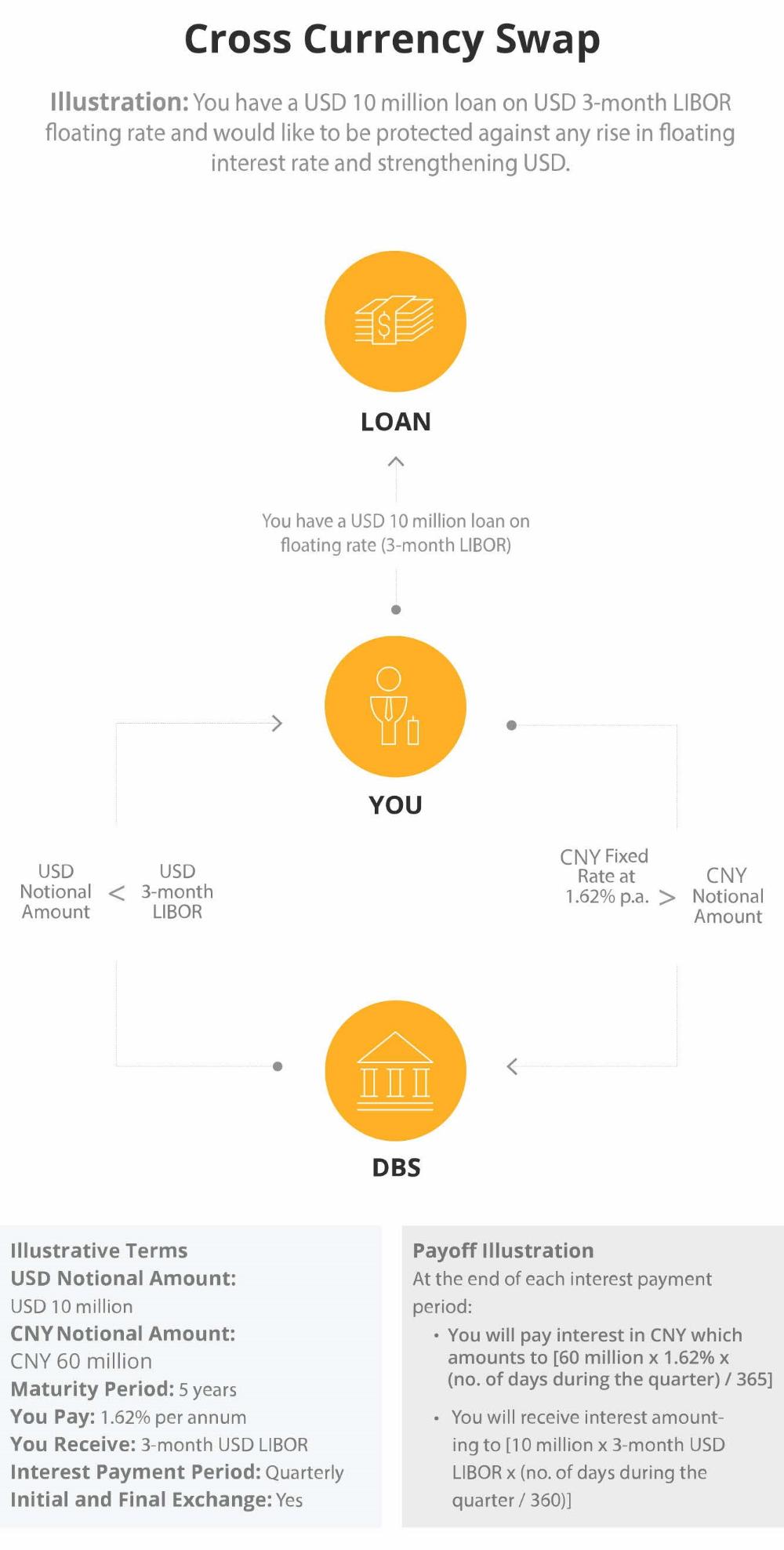

Cross-Currency Swap

Cross-currency swaps allow you to hedge both currency and interest rates risk conveniently in one transaction.

Get in Touch

Let our team of experts share how we can support your specific

business goals through our suite of expertise, technology and solutions.

business goals through our suite of expertise, technology and solutions.