Forex - Foreign Exchange | DBS CN Corporate Banking

- Solutions

- Global Financial Markets

- Foreign Exchange

Foreign Exchange

Hedge your FX risks with our dedicated Global Financial Markets specialists

- Solutions

- Global Financial Markets

- Foreign Exchange

Foreign Exchange

Hedge your FX risks with our dedicated Global Financial Markets specialists

Please use valid input

Please provide your details to continue reading. DBS FX Online

Book FX transactions wherever you are through DBS’ world-class forex platform

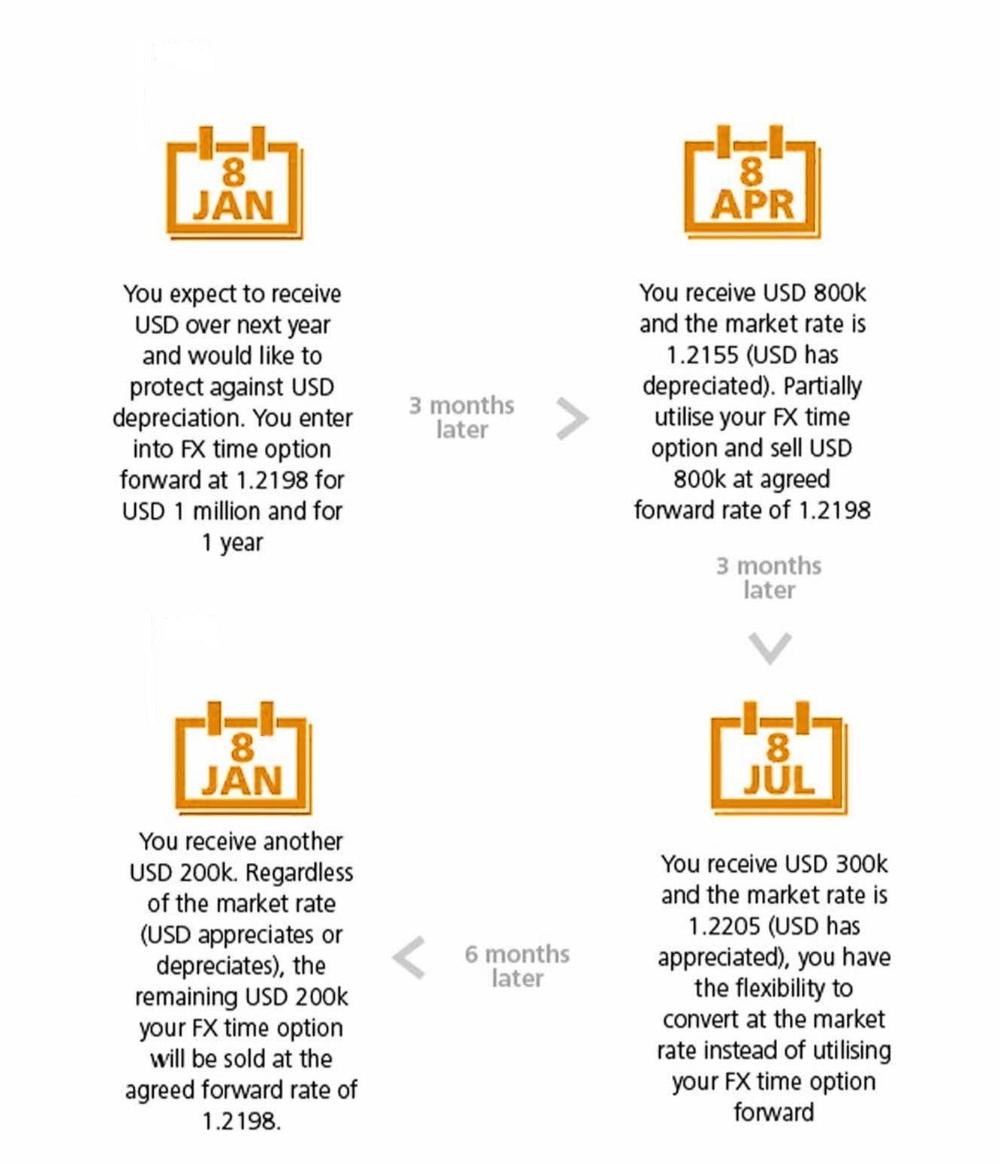

FX Time Option Forward

Mitigate your forex volatility risk in a more flexible way

FX Value Today

Convert your currencies immediately

FX Forward

Protect your business from exchange rate volatility

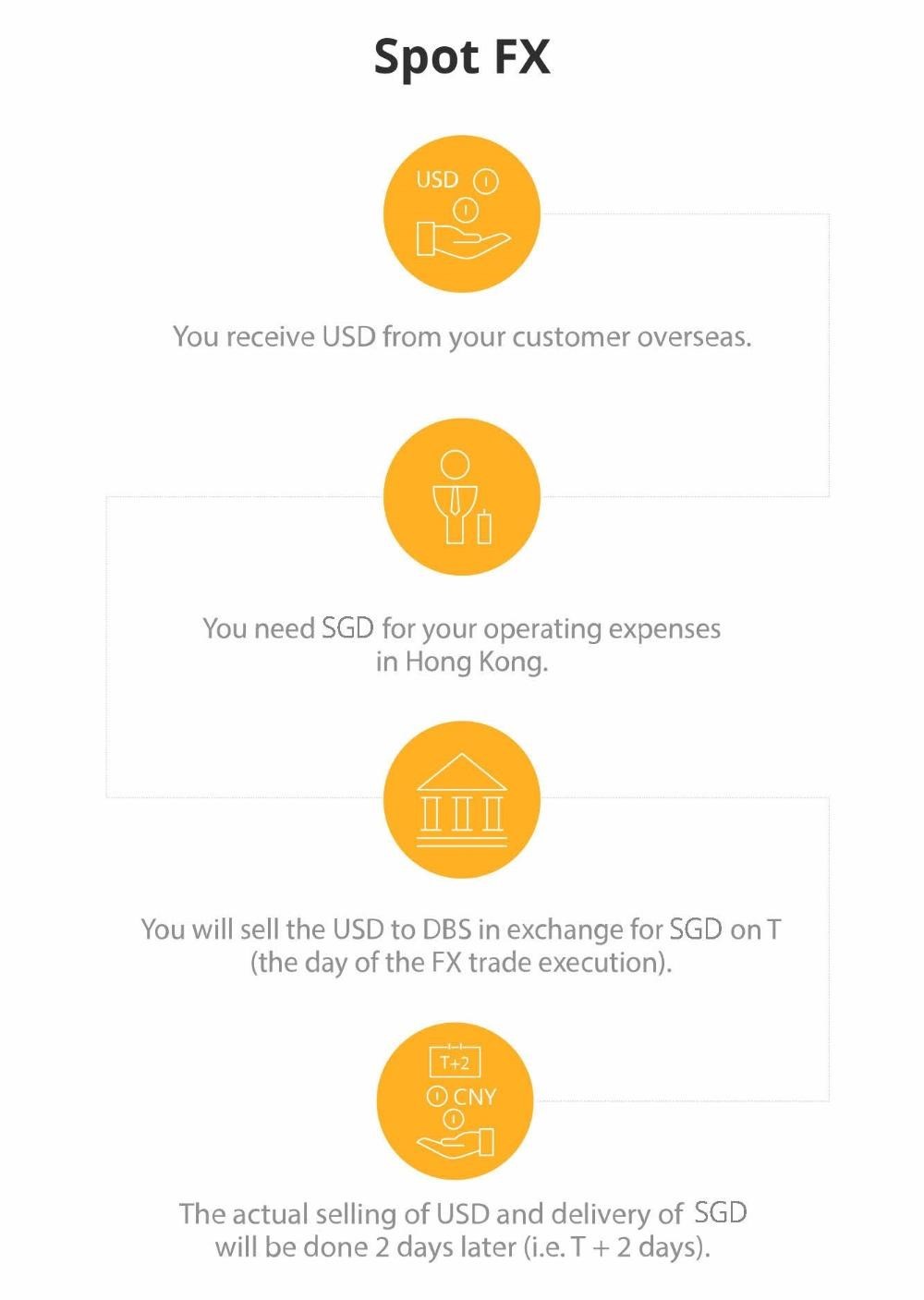

Spot FX

Convert your currencies for future delivery

FX Option

Manage market volatility, FX and interest rate reform risks with greater autonomy and flexibility

FAQs

Get in Touch

Let our team of experts share how we can support your specific

business goals through our suite of expertise, technology and solutions.

business goals through our suite of expertise, technology and solutions.