- Solutions

- Trade Finance

- Open Account Trade

- Supply Chain Finance

Supply Chain Finance

Free up your working capital

- Solutions

- Trade Finance

- Open Account Trade

- Supply Chain Finance

Supply Chain Finance

Free up your working capital

Supply Chain Finance (SCF) helps free up cash trapped in supply chain process for both suppliers and buyers. DBS offers SCF programs for client’s Procurement (Supplier Finance) and Sales (Buyer Finance).

Programme based solution

Enabling a continual flow of liquidity access for both suppliers and buyers

Onboarding

Seamless onboarding process minimises hassle and reduces turnaround time

Paperless Processing

Automated processing reduces paper transactions

| Pre-shipment Supplier Finance | Post-Shipment Supplier Finance | Buyer Finance |

|---|---|---|

| As a supplier, you enjoy:

| As a supplier, you enjoy:

| As a buyer, you enjoy:

|

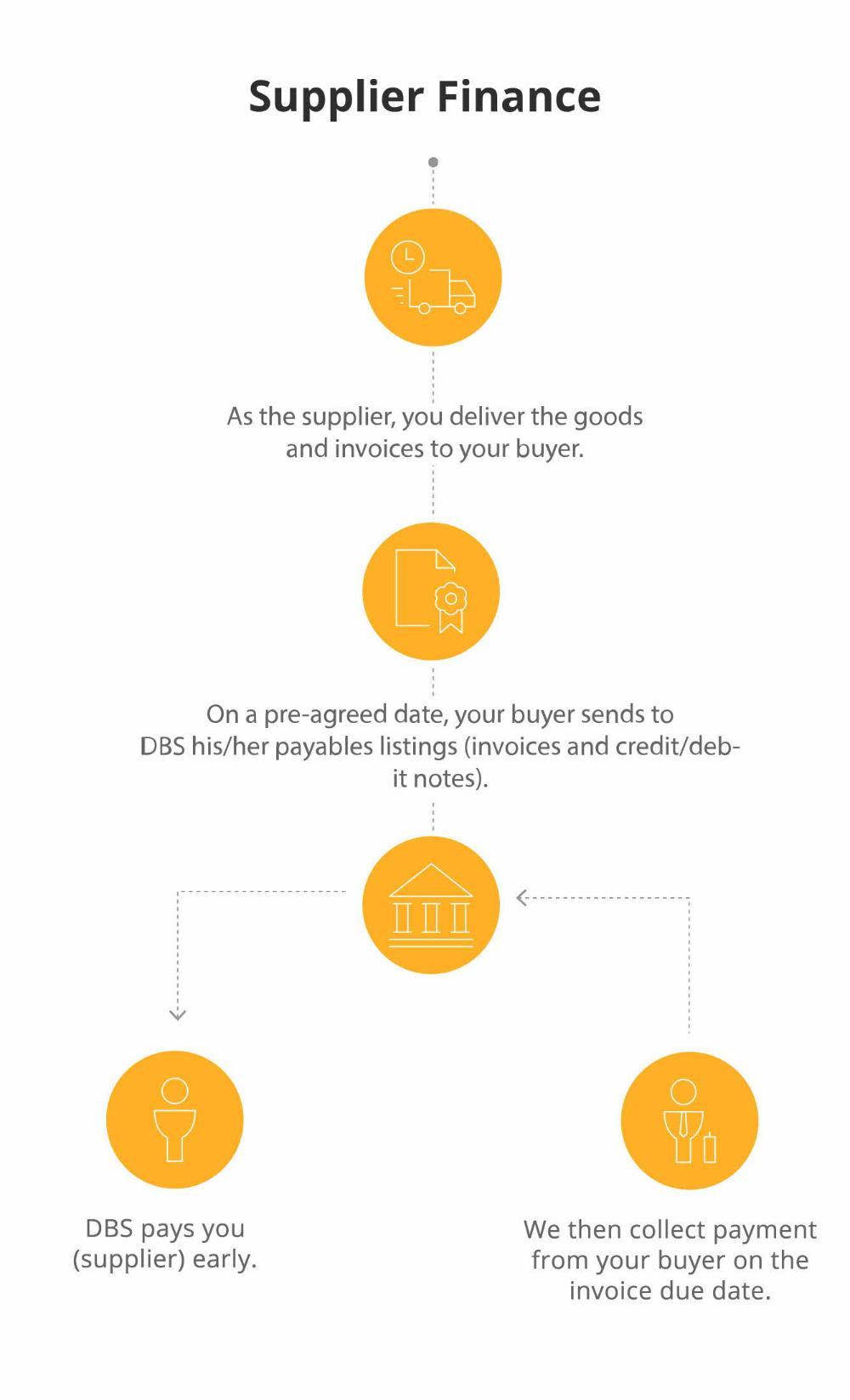

Supplier Finance for you as a Supplier

Through a Buyer-led Supplier Finance programme, DBS will provide an early payment to you based on confirmed invoices by your Buyer. Here’s how it works:

- As a supplier, you deliver the goods and invoice to your buyer.

- Your buyer sends us the invoice listing.

- We provide you with early payment.

- We collect payment from your buyer on the invoice due date.

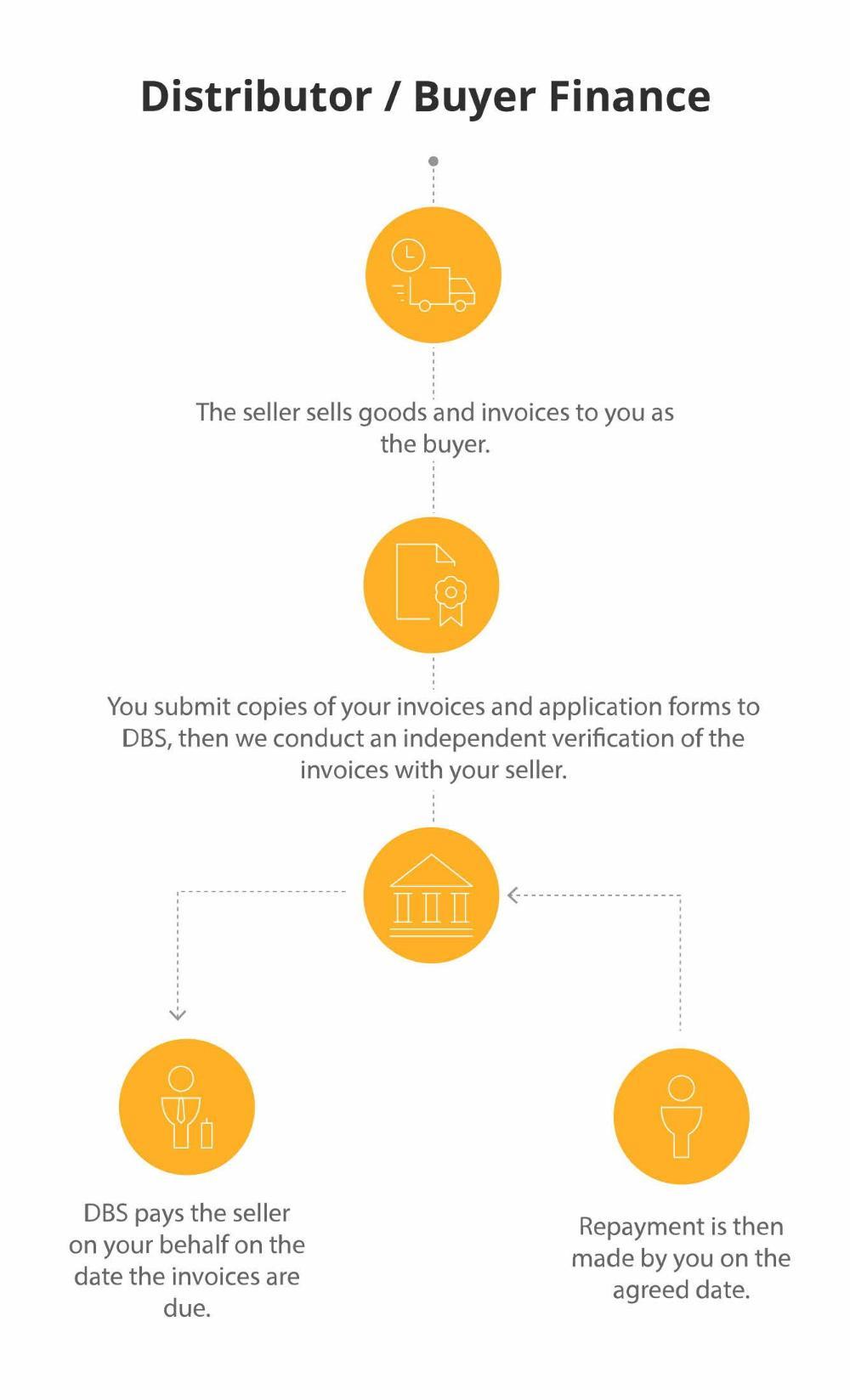

Through a Seller-led programme, DBS will help you to finance your purchase from your Seller. Here’s how it works:

- Your seller sells goods and invoices to you.

- You submit copies of your invoices on or before invoice due date.

- We pay your seller on your behalf.

- You repay us on financing due date.

Call us on 400 821 8881 or visit any of our Branches for more details. You may also email us and arrange our Relationship Manager to call you.

| What sales / purchases qualify for this financing? | |

| Trade transactions must be on open account terms and occur on a recurring basis. One-off sales or purchases do not qualify. |